Understanding the Critical Choice: OEM vs. Aftermarket Electrical Components

In the competitive landscape of electrical component distribution, one decision significantly impacts your business’s profitability, customer satisfaction, and market positioning: choosing between OEM (Original Equipment Manufacturer) and aftermarket electrical components. As distributors navigate increasingly complex supply chains and demanding customer expectations, understanding the nuances between these two sourcing strategies becomes paramount to success.

This comprehensive guide explores the critical differences between OEM and aftermarket electrical components, examining quality standards, cost implications, reliability factors, and strategic considerations that electrical distributors must evaluate. Whether you’re sourcing circuit breakers, contactors, relays, transformers, or control panels, making informed procurement decisions directly affects your bottom line and competitive advantage.

What is an OEM in Electrical Component Manufacturing?

An Original Equipment Manufacturer (OEM) in the electrical components industry refers to companies that design, engineer, and produce components specifically for integration into finished electrical systems or equipment. These manufacturers create parts according to exact specifications, meeting stringent industry standards and regulatory requirements.

OEM electrical components are those produced by or for the same company that designed the original product or system. When distributors source OEM parts, they’re obtaining components that maintain the exact specifications, materials, and quality standards established by the original designer. For example, if an automation system was originally built with Schneider Electric contactors, the OEM replacement would be an authentic Schneider Electric component, not an alternative brand.

Key Characteristics of OEM Electrical Components

- Precision Engineering: Designed to exact specifications for specific applications

- Quality Assurance: Manufactured under strict quality control protocols

- Certification Compliance: Meet industry-specific standards (ISO 9001, UL, IEC, IATF 16949)

- Traceability: Complete documentation and component genealogy

- Warranty Protection: Comprehensive manufacturer warranties

- Technical Support: Direct access to engineering resources and documentation

Aftermarket Electrical Components Explained

Aftermarket electrical components are manufactured by third-party companies not affiliated with the original equipment manufacturer. These suppliers design and produce components intended to serve as compatible alternatives to OEM parts, often at more competitive price points.

Aftermarket manufacturers reverse-engineer or develop components that match the form, fit, and function of OEM parts without being produced by the original designer. Quality varies significantly across aftermarket suppliers, ranging from components that meet or exceed OEM standards to substandard products that may compromise system performance and safety.

Aftermarket Component Categories

- Premium Aftermarket: High-quality alternatives that meet or exceed OEM specifications

- Standard Aftermarket: Components meeting basic functional requirements

- Economy Aftermarket: Budget-focused alternatives with minimal quality assurance

- Remanufactured: Restored OEM components meeting specific quality standards

Comprehensive Comparison: OEM vs. Aftermarket Electrical Components

Quality Standards and Certifications

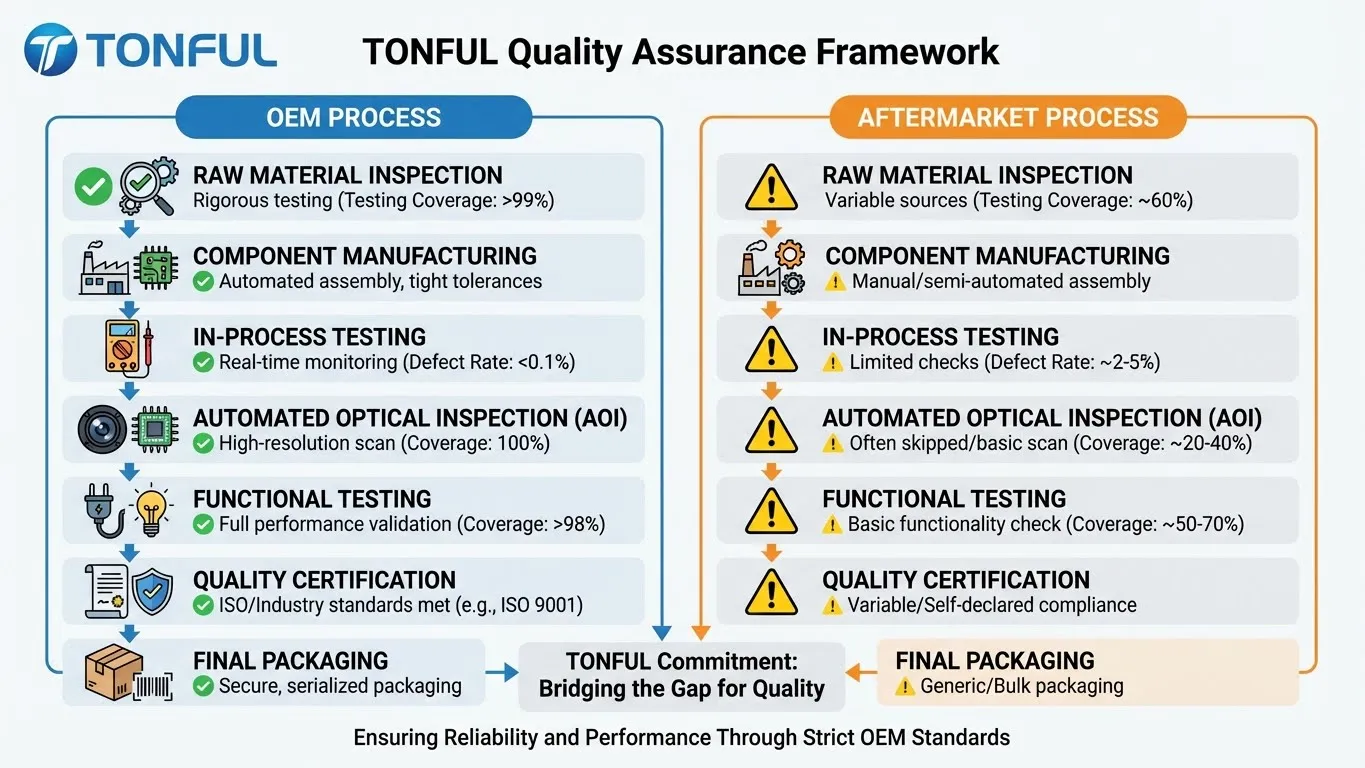

Quality assurance represents the most critical differentiator between OEM and aftermarket electrical components. OEM manufacturers invest heavily in quality management systems, adhering to internationally recognized standards that govern every aspect of production, from material sourcing to final testing.

Industry-Standard Certifications

ISO 9001 serves as the foundation for quality management in electrical component manufacturing. This globally recognized standard establishes comprehensive frameworks for quality control, continuous improvement, and customer satisfaction. OEM manufacturers typically maintain ISO 9001 certification, demonstrating commitment to consistent quality delivery.

IATF 16949 extends ISO 9001 requirements specifically for automotive electrical components, emphasizing defect prevention, reduction of variation, and supply chain management. Distributors serving automotive markets must prioritize suppliers with IATF 16949 certification to ensure compliance with automotive industry quality requirements.

UL Certification (Underwriters Laboratories) validates electrical safety, testing components for fire, electrical shock, and other hazards. UL-certified components undergo rigorous safety testing, providing assurance for end-users and reducing liability exposure for distributors. OEM electrical components typically carry UL certification, while aftermarket alternatives may lack this critical safety validation.

IPC Standards govern electronics manufacturing, particularly IPC-A-610 (Acceptability of Electronic Assemblies) and IPC-J-STD-001 (Requirements for Soldered Electrical and Electronic Assemblies). These standards ensure workmanship quality, proper assembly techniques, and reliable electrical connections. Over 3,500 certified trainers worldwide teach IPC standards, demonstrating their importance in global electronics manufacturing.

| Certification Standard | OEM Components | Premium Aftermarket | Standard Aftermarket |

|---|---|---|---|

| ISO 9001 | ✓ Required | ✓ Common | ○ Sometimes |

| IATF 16949 (Automotive) | ✓ Required | ○ Selective | ✗ Rare |

| UL Safety Certification | ✓ Standard | ○ Variable | ○ Limited |

| IPC Standards Compliance | ✓ Mandatory | ○ Selective | ✗ Uncommon |

| ISO 13485 (Medical Devices) | ✓ Required | ○ Specialized | ✗ Rare |

| RoHS Compliance | ✓ Standard | ✓ Common | ○ Variable |

| CE Marking | ✓ Required | ○ Common | ○ Variable |

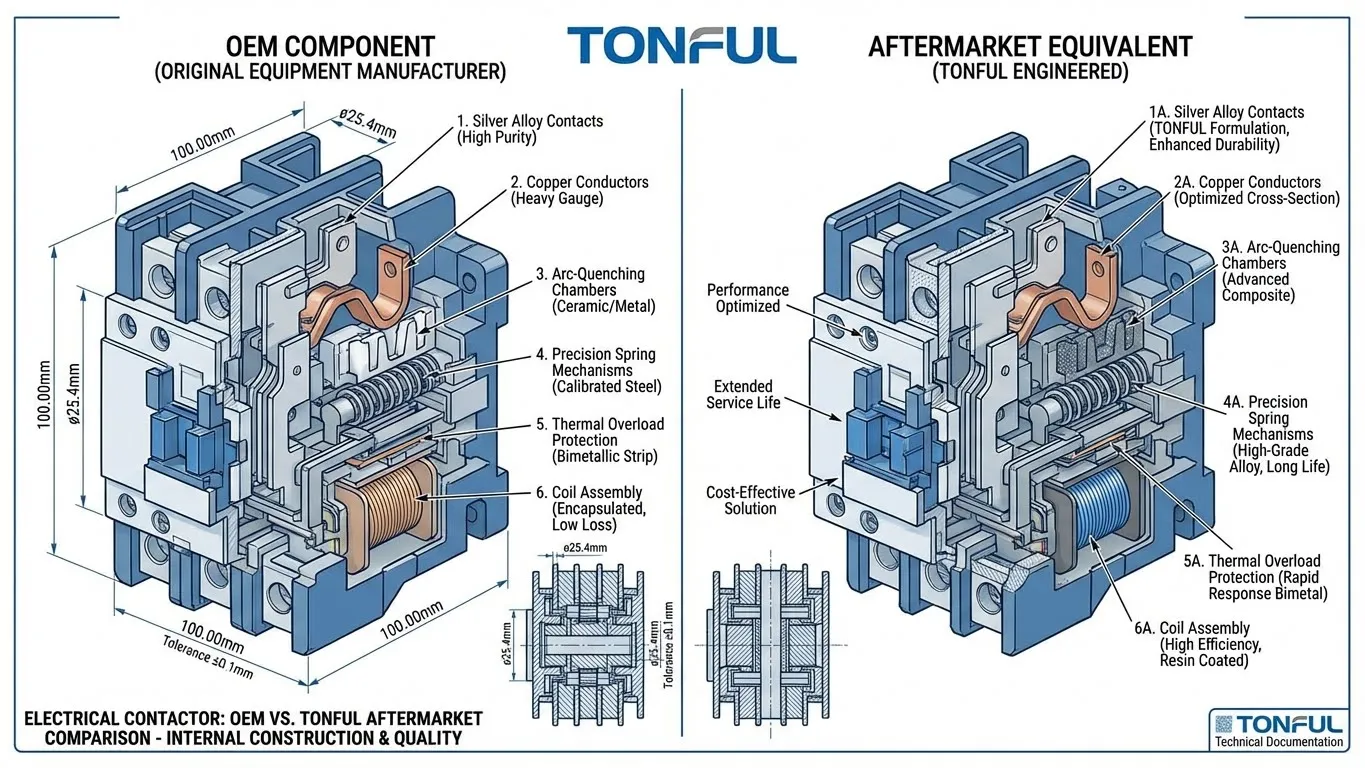

Manufacturing Quality Control

OEM manufacturers implement stringent quality control protocols throughout production. These include incoming material inspection, in-process verification, automated optical inspection (AOI), functional testing, and final quality audits. Statistical process control (SPC) methods ensure manufacturing consistency and early defect detection.

Aftermarket manufacturers vary significantly in quality control rigor. Premium aftermarket suppliers may implement quality systems comparable to OEM standards, while economy suppliers might employ minimal quality verification. Distributors must conduct thorough supplier audits to assess aftermarket manufacturers’ quality capabilities.

Pricing and Total Cost of Ownership Analysis

Price represents the most apparent difference between OEM and aftermarket electrical components, with aftermarket alternatives typically offering 20-50% cost savings compared to OEM equivalents. However, savvy distributors recognize that upfront purchase price constitutes only one element of total cost of ownership (TCO).

Upfront Cost Comparison

| Component Category | OEM Price Index | Aftermarket Price Index | Potential Savings |

|---|---|---|---|

| Circuit Breakers | 100% (baseline) | 60-80% | 20-40% |

| Contactors | 100% (baseline) | 50-70% | 30-50% |

| Relays | 100% (baseline) | 55-75% | 25-45% |

| Transformers | 100% (baseline) | 65-85% | 15-35% |

| Control Panels | 100% (baseline) | 70-90% | 10-30% |

| Sensors | 100% (baseline) | 45-65% | 35-55% |

| Terminal Blocks | 100% (baseline) | 50-70% | 30-50% |

Hidden Cost Factors

Warranty Coverage: OEM components typically include comprehensive manufacturer warranties (12-36 months standard), while aftermarket warranties vary significantly. Warranty claims, replacement logistics, and customer downtime create hidden costs that offset initial price savings.

Failure Rates: Higher failure rates in economy aftermarket components generate replacement costs, labor expenses, shipping charges, and customer dissatisfaction. Industry data suggests economy aftermarket electrical components exhibit 2-5x higher failure rates compared to OEM equivalents.

Technical Support: OEM manufacturers provide engineering support, technical documentation, application guidance, and troubleshooting assistance. Aftermarket suppliers may offer limited technical resources, creating additional burden on distributor support teams.

Compatibility Issues: Aftermarket components occasionally exhibit dimensional variations, mounting differences, or electrical specification deviations that create installation challenges. These compatibility issues generate labor costs and project delays.

Liability Exposure: Component failures in critical applications create liability exposure. OEM components with proper certifications reduce distributor liability, while uncertified aftermarket alternatives increase legal risk.

TCO Calculation Framework

Total Cost of Ownership = Purchase Price + (Failure Rate × Replacement Cost) + (Warranty Service Cost) + (Technical Support Cost) + (Liability Risk Cost) + (Inventory Carrying Cost) - (Warranty Coverage Value)

Distributors must evaluate TCO rather than solely focusing on purchase price. Premium aftermarket components from reputable manufacturers may offer genuine value, while economy alternatives often prove more expensive long-term despite lower upfront costs.

Reliability and Performance Considerations

Electrical component reliability directly impacts system uptime, maintenance costs, and customer satisfaction. OEM components undergo extensive reliability testing, including accelerated life testing, environmental stress screening, and long-term performance validation.

Reliability Metrics

Mean Time Between Failures (MTBF): OEM electrical components typically achieve MTBF ratings of 100,000-1,000,000 hours under specified operating conditions. Aftermarket components may lack documented MTBF data or exhibit significantly lower reliability ratings.

Environmental Performance: OEM components specify exact operating temperature ranges, humidity tolerance, vibration resistance, and environmental protection ratings (IP ratings). Aftermarket alternatives may not undergo equivalent environmental testing.

Electrical Specifications: OEM components guarantee precise electrical characteristics—voltage ratings, current capacities, insulation resistance, dielectric strength, and contact resistance. Aftermarket components may exhibit specification variations that affect performance in critical applications.

| Performance Factor | OEM Components | Premium Aftermarket | Economy Aftermarket |

|---|---|---|---|

| MTBF Documentation | Complete | Often Available | Rarely Available |

| Environmental Testing | Comprehensive | Variable | Limited |

| Electrical Spec Tolerance | ±2-5% | ±5-10% | ±10-20% |

| Long-term Stability | Excellent | Good-Excellent | Variable |

| Application Documentation | Extensive | Moderate | Minimal |

| Field Performance Data | Published | Limited | Rare |

Supply Chain and Availability Dynamics

Supply chain reliability significantly impacts distributor operations. Component availability, lead times, and supply consistency affect inventory management, customer service levels, and business continuity.

OEM Supply Chain Characteristics

Authorized Distribution Networks: OEM manufacturers establish authorized distributor networks ensuring genuine components, proper storage handling, and supply chain integrity. Authorized distributors receive priority allocation during component shortages.

Lead Time Predictability: OEM manufacturers provide reliable lead time commitments, enabling distributors to plan inventory accurately. Production schedules, capacity planning, and demand forecasting create supply predictability.

Supply Consistency: OEM components maintain consistent specifications across production batches, eliminating concerns about specification drift or quality variations between orders.

Allocation Management: During component shortages, OEM manufacturers implement allocation systems prioritizing established distributors and critical applications.

Aftermarket Supply Chain Characteristics

Independent Sourcing: Aftermarket distributors source from multiple manufacturers, creating supply flexibility but potential quality inconsistency.

Opportunistic Availability: Aftermarket suppliers often maintain larger inventories of legacy components, providing solutions for obsolete OEM products.

Variable Lead Times: Aftermarket lead times vary significantly based on manufacturer capacity, inventory levels, and production priorities.

Quality Variability: Batch-to-batch quality variations occur more frequently with aftermarket components, requiring enhanced incoming inspection protocols.

| Supply Chain Factor | OEM Components | Aftermarket Components |

|---|---|---|

| Lead Time Reliability | High | Variable |

| Inventory Availability | Moderate-High | Often Higher |

| Batch Consistency | Excellent | Variable |

| Legacy Component Access | Declining | Often Better |

| Supply Chain Transparency | High | Variable |

| Emergency Availability | Priority System | Opportunistic |

| Counterfeit Risk | Very Low | Elevated |

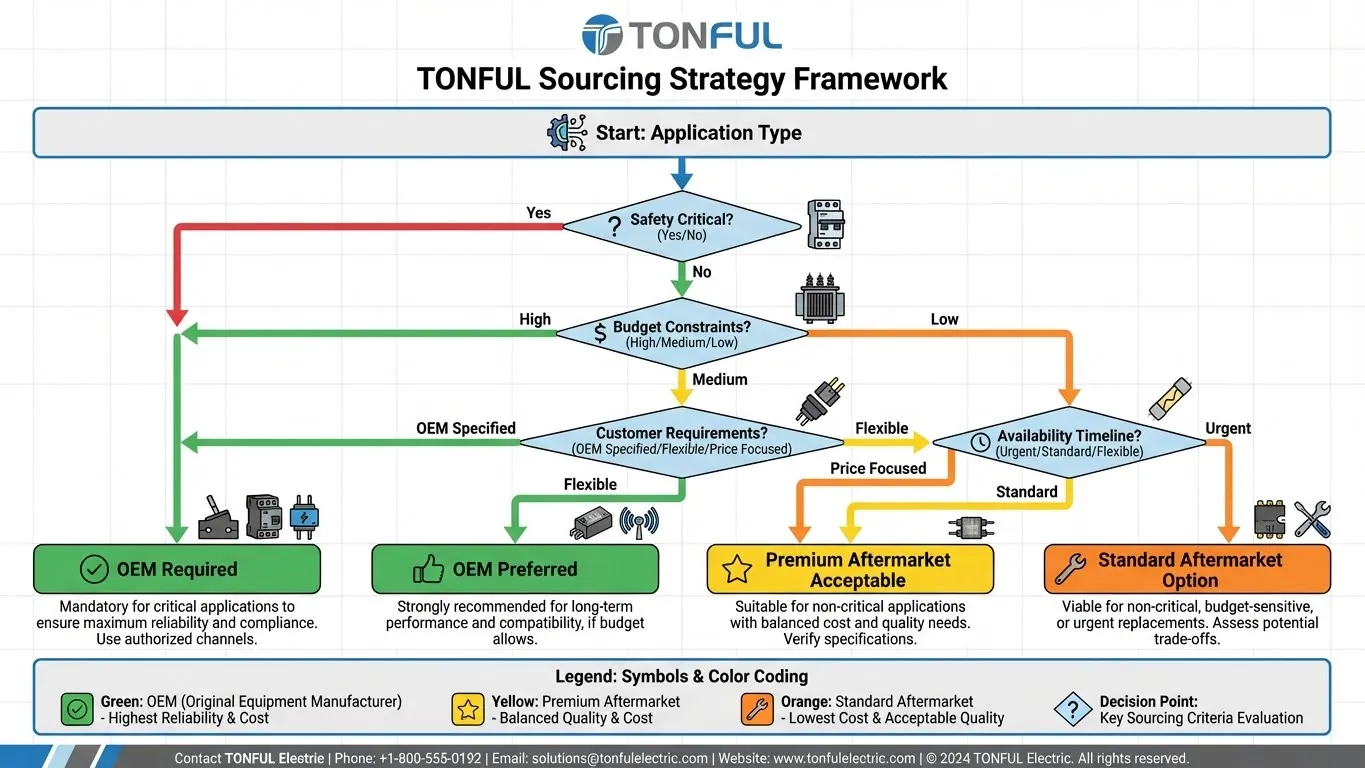

Strategic Decision Framework for Distributors

Electrical distributors must develop strategic frameworks for OEM versus aftermarket sourcing decisions. Different applications, customer segments, and market conditions warrant different sourcing approaches.

Application-Based Decision Matrix

Critical Safety Systems: OEM components mandatory for applications where failure creates safety hazards—power distribution systems, emergency shutdown circuits, life safety equipment, medical devices, and aerospace applications.

High-Reliability Industrial: OEM components preferred for continuous process industries, automated manufacturing systems, and applications where downtime costs exceed component price premiums.

Standard Commercial Applications: Premium aftermarket acceptable for commercial building systems, HVAC controls, lighting systems, and general-purpose applications with lower criticality.

Maintenance and Repair: Aftermarket alternatives suitable for non-critical maintenance applications, legacy system repairs, and cost-sensitive retrofit projects.

Cost-Sensitive Projects: Economy aftermarket viable for extreme price-sensitive applications where customers accept higher failure risk trade-offs.

Customer Segment Strategies

OEM Equipment Manufacturers: Require OEM components for warranty compliance, liability management, and brand reputation protection.

Industrial End-Users: Value OEM components for critical systems, accept premium aftermarket for standard applications based on TCO analysis.

Contractors and Installers: Price-sensitive segment often preferring aftermarket alternatives for competitive bidding scenarios.

Maintenance Organizations: Frequently specify OEM for critical systems, utilize aftermarket for non-critical applications.

Government and Institutional: Typically require OEM components meeting specific procurement standards and certification requirements.

Hybrid Sourcing Strategies

Leading distributors implement hybrid sourcing strategies, leveraging OEM components for critical applications while utilizing aftermarket alternatives where appropriate. This balanced approach optimizes profitability while maintaining quality standards and customer satisfaction.

Portfolio Optimization

Core Product Lines: Maintain OEM components for high-volume, high-visibility product categories where brand reputation and reliability differentiate your distribution business.

Commodity Components: Source premium aftermarket for standardized components where performance equivalency exists and customers accept alternatives.

Legacy Support: Utilize aftermarket suppliers specializing in obsolete component manufacturing for legacy system support.

Emergency Inventory: Maintain aftermarket alternatives for emergency situations when OEM lead times exceed customer requirements.

Supplier Relationship Management

OEM Partnerships: Develop strong relationships with OEM manufacturers, securing preferred pricing, allocation priority, and technical support access.

Aftermarket Qualification: Implement rigorous supplier qualification processes for aftermarket manufacturers, including facility audits, quality system assessments, and product testing.

Performance Monitoring: Establish key performance indicators (KPIs) tracking supplier quality, delivery performance, and customer satisfaction across OEM and aftermarket sources.

Continuous Evaluation: Regularly reassess sourcing strategies based on market conditions, technology changes, and customer requirements evolution.

Quality Assurance Best Practices for Distributors

Regardless of sourcing strategy, distributors must implement robust quality assurance processes protecting customers and business reputation.

Incoming Inspection Protocols

- Visual Inspection: Examine packaging integrity, component markings, and visual quality indicators

- Dimensional Verification: Measure critical dimensions ensuring form-fit compatibility

- Electrical Testing: Verify key electrical parameters using calibrated test equipment

- Documentation Review: Validate certifications, test reports, and traceability documentation

- Sample Testing: Conduct statistical sampling for large quantity purchases

- Counterfeit Detection: Implement anti-counterfeiting measures including X-ray inspection and material analysis

Supplier Audit Programs

Facility Audits: Conduct on-site assessments of manufacturing facilities, quality systems, and production capabilities for critical suppliers.

Quality System Evaluation: Review ISO certifications, quality procedures, and continuous improvement programs.

Process Capability Studies: Assess manufacturing process consistency and capability using statistical methods.

Corrective Action Management: Establish systems for addressing quality issues, implementing corrective actions, and preventing recurrence.

Market Trends and Future Outlook

The electrical components market continues evolving, influenced by technological advancement, sustainability initiatives, and global supply chain dynamics.

Industry Transformation Trends

Digital Transformation: Smart components with embedded sensors, communication capabilities, and predictive maintenance features are becoming standard, with OEM manufacturers leading innovation.

Sustainability Focus: Environmental regulations drive demand for energy-efficient components, recyclable materials, and sustainable manufacturing practices. OEM manufacturers invest heavily in sustainable product development.

Supply Chain Regionalization: Recent global disruptions accelerate supply chain regionalization, affecting component sourcing strategies and supplier relationships.

Counterfeit Combat: Industry initiatives enhance authentication technologies, traceability systems, and supply chain security measures protecting against counterfeit components.

Automation Integration: Industry 4.0 integration requires components with digital communication capabilities, standardized interfaces, and cybersecurity features—areas where OEM manufacturers maintain technological leadership.

Practical Implementation Roadmap

Distributors seeking to optimize their OEM versus aftermarket sourcing strategy should follow this implementation roadmap:

Phase 1: Assessment (Weeks 1-4)

- Analyze current product portfolio and sourcing mix

- Evaluate customer segments and application requirements

- Review quality incident data and warranty costs

- Assess competitive positioning and market opportunities

Phase 2: Strategy Development (Weeks 5-8)

- Define sourcing policies by product category

- Establish quality standards and acceptance criteria

- Develop supplier qualification requirements

- Create decision frameworks and approval processes

Phase 3: Supplier Development (Weeks 9-16)

- Identify and evaluate potential suppliers

- Conduct facility audits and capability assessments

- Negotiate agreements and establish relationships

- Implement quality assurance protocols

Phase 4: Execution (Weeks 17-24)

- Phase in new sourcing strategies

- Train sales and technical staff

- Communicate changes to customers

- Monitor performance and adjust strategies

Phase 5: Optimization (Ongoing)

- Track KPIs and performance metrics

- Gather customer feedback and market intelligence

- Continuously evaluate and refine strategies

- Adapt to market changes and technology evolution

Frequently Asked Questions

Q: What is the main difference between OEM and aftermarket electrical components?

A: OEM (Original Equipment Manufacturer) components are produced by or for the company that designed the original equipment, maintaining exact specifications and quality standards. Aftermarket components are manufactured by third-party companies as compatible alternatives. OEM components typically offer superior quality assurance, comprehensive warranties, and guaranteed compatibility, while aftermarket options provide cost savings but with variable quality depending on the manufacturer.

Q: Are aftermarket electrical components safe to use?

A: Safety depends entirely on the aftermarket manufacturer’s quality standards. Premium aftermarket suppliers producing UL-certified, ISO 9001-compliant components meeting industry standards can be as safe as OEM alternatives. However, economy aftermarket components lacking proper certifications and testing may pose safety risks. Distributors must implement rigorous supplier qualification and quality verification processes for aftermarket sources. For safety-critical applications, OEM components remain the preferred choice.

Q: How much can distributors save by choosing aftermarket components?

A: Aftermarket components typically offer 20-50% upfront cost savings compared to OEM equivalents, varying by component category and supplier. However, total cost of ownership analysis reveals that these savings may be offset by higher failure rates, limited warranties, compatibility issues, and technical support costs. Premium aftermarket alternatives from reputable manufacturers often provide genuine value, while economy options may prove more expensive long-term despite lower purchase prices.

Q: Which quality certifications should distributors prioritize when sourcing electrical components?

A: Essential certifications include ISO 9001 (quality management), UL certification (electrical safety), RoHS compliance (environmental), and IPC standards for electronic assemblies. For automotive applications, IATF 16949 certification is mandatory. Medical device components require ISO 13485 certification. Distributors should verify that both OEM and aftermarket suppliers maintain relevant certifications for their target markets and applications.

Q: When should distributors choose OEM over aftermarket components?

A: OEM components are essential for: safety-critical applications where failure creates hazards; systems requiring warranty compliance; applications demanding documented reliability and traceability; customers specifically requiring OEM components; and new equipment manufacturing. OEM is preferred for high-reliability industrial systems where downtime costs exceed price premiums. Aftermarket alternatives are acceptable for non-critical maintenance, cost-sensitive projects, and legacy system support where OEM components are unavailable.

Q: How can distributors protect against counterfeit electrical components?

A: Implement multi-layered protection strategies: source exclusively from authorized distributors and verified suppliers; conduct physical inspections examining markings, packaging, and build quality; verify certification documentation and traceability; perform electrical testing on sample components; utilize X-ray inspection and material analysis for high-risk purchases; establish secure supply chains with transparency; and maintain relationships with OEM manufacturers providing authentication support. Counterfeit risk is significantly lower with authorized OEM distributors compared to gray market aftermarket sources.

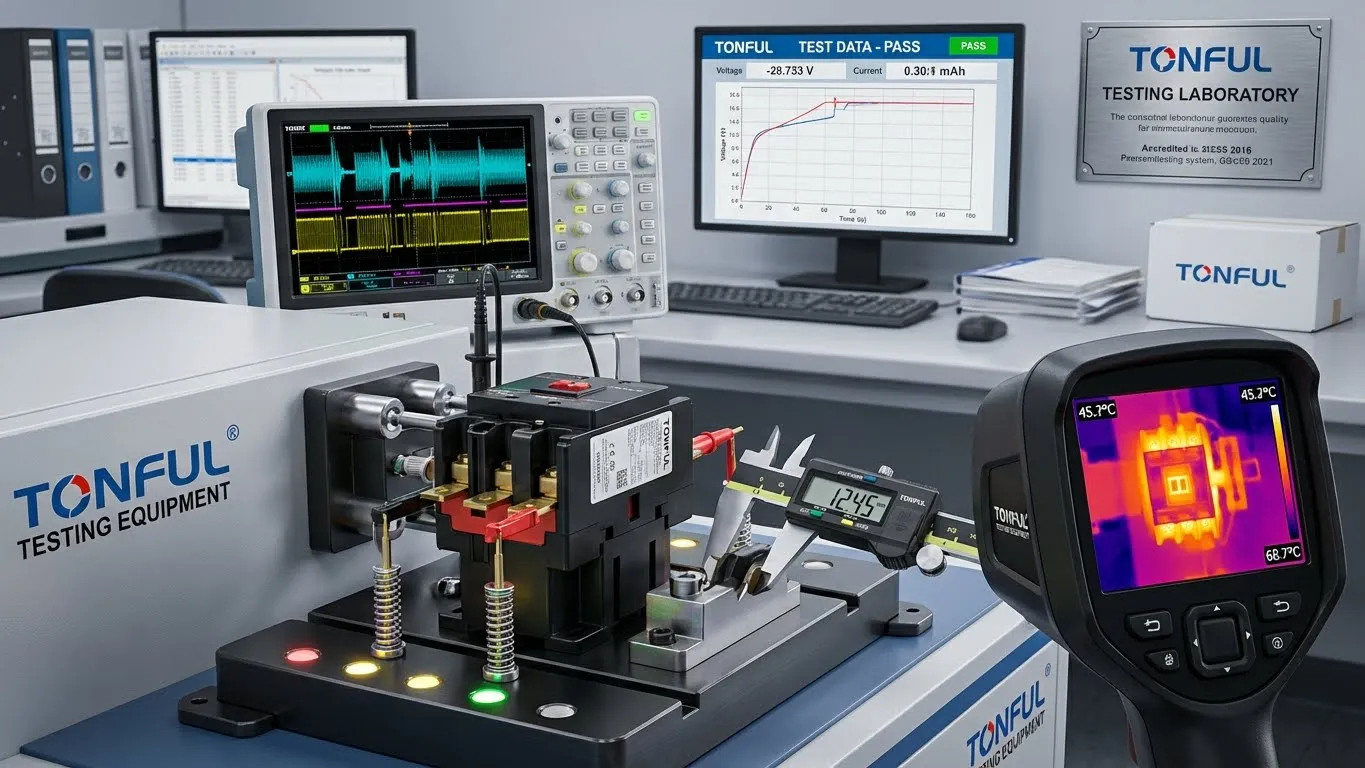

Q: What role does TONFUL Electric play in the OEM electrical components market?

A: TONFUL Electric serves as a leading B2B manufacturer of electrical products, producing OEM-quality components meeting international standards including ISO 9001, UL, and IPC certifications. TONFUL combines advanced manufacturing capabilities, rigorous quality control, competitive pricing, and comprehensive technical support. As distributors evaluate sourcing strategies, TONFUL offers the quality assurance of OEM manufacturing with the value positioning that makes components accessible across diverse market segments and applications.

About TONFUL Electric: As a leading manufacturer of electrical components, TONFUL Electric combines precision engineering, advanced manufacturing, and comprehensive quality assurance to deliver OEM-quality products for global markets. With ISO 9001 certification, state-of-the-art production facilities, and experienced technical support teams, TONFUL serves distributors seeking reliable electrical components that meet the highest industry standards. Contact our team to discuss your component sourcing requirements and discover how TONFUL Electric can support your distribution business success.